South Florida Market Update: What’s Really Happening in Fort Lauderdale, Wilton Manors & Pompano Beach (October 2025)

South Florida Market Update: What’s Really Happening in Fort Lauderdale, Wilton Manors & Pompano Beach (October 2025)

Are You Wondering Where Our Market Is Really Heading?

If you’ve been scrolling through headlines lately, you’ve probably seen two totally different stories about the housing market:

- Story #1: “South Florida Home Prices Surge!”

- Story #2: “Housing Market Slowdown!”

Both of those can technically be “true” on paper. That’s exactly how clickbait gets made.

The reality on the ground in Fort Lauderdale, Wilton Manors, and Pompano Beach is much more nuanced. Our market isn’t one big South Florida story. It’s three different cities, two very different product types (single-family vs. condo/townhome), and each one is behaving in its own way.

In this update, I’m breaking down the real numbers from BeachesMLS Local Market Update – October 2025, looking at both:

- YOY (Year-over-Year October vs. October)

- YTD (Year-to-Date, January through October)

Because when you only look at one of those, you only see half the truth. When you look at both—and layer in the micro-trends by city and property type—you get an accurate picture of what’s really going on.

Why YOY vs. YTD Can Tell Two Very Different Stories

Let’s start with how the data itself can be misleading if you only see part of it.

YOY (Year-over-Year)

YOY compares one month this year to the same month last year. For example: October 2025 vs. October 2024.

That can look dramatic—especially if last year’s month was unusually low or unusually high. It’s great for headlines, not always great for context.

YTD (Year-to-Date)

YTD smooths out the noise. It looks at the entire period from January through October and compares that to the same period last year.

It tends to be much better at revealing the actual trend instead of reacting to a one-month blip.

How Clickbait Happens

If one month spikes or dips sharply, YOY can scream:

- “Prices up 30%!” – even if the rest of the year was flat or softening.

- “Market crashes!” – even if it was just one weird month with a small sample size.

That’s how confusing market headlines get written. My job is to go beyond that, look at both the macro (overall city-level trends) and micro (neighborhood, building, and property type), and help you understand what’s really happening in the market where you own or want to own.

Median vs. Average Price: Two Numbers, Two Different Stories

Another big piece of the puzzle right now is the difference between median and average prices. In a market like ours—with everything from original-condition 1960s condos to new-construction waterfront homes—those two numbers can diverge a lot.

Median Price

The median price is the middle sale in the dataset. Half the homes sold for more, half sold for less. It’s usually the best indicator of what a “typical” buyer in that market is actually paying.

Average Price

The average price is all the sales added together and divided by the number of sales. It’s extremely sensitive to outliers. A few very high-end sales can pull the average up, even while the median stays flat or falls.

How to Read Them Together

- Median up, average down: mid-priced homes are selling well, but fewer ultra-luxury properties are closing.

- Average up, median down: a small number of high-end sales are happening while the broader, mid-range market is under pressure.

Looking at both median and average—along with days on market and months of supply—gives you a much clearer understanding of what’s really going on in each segment of the market.

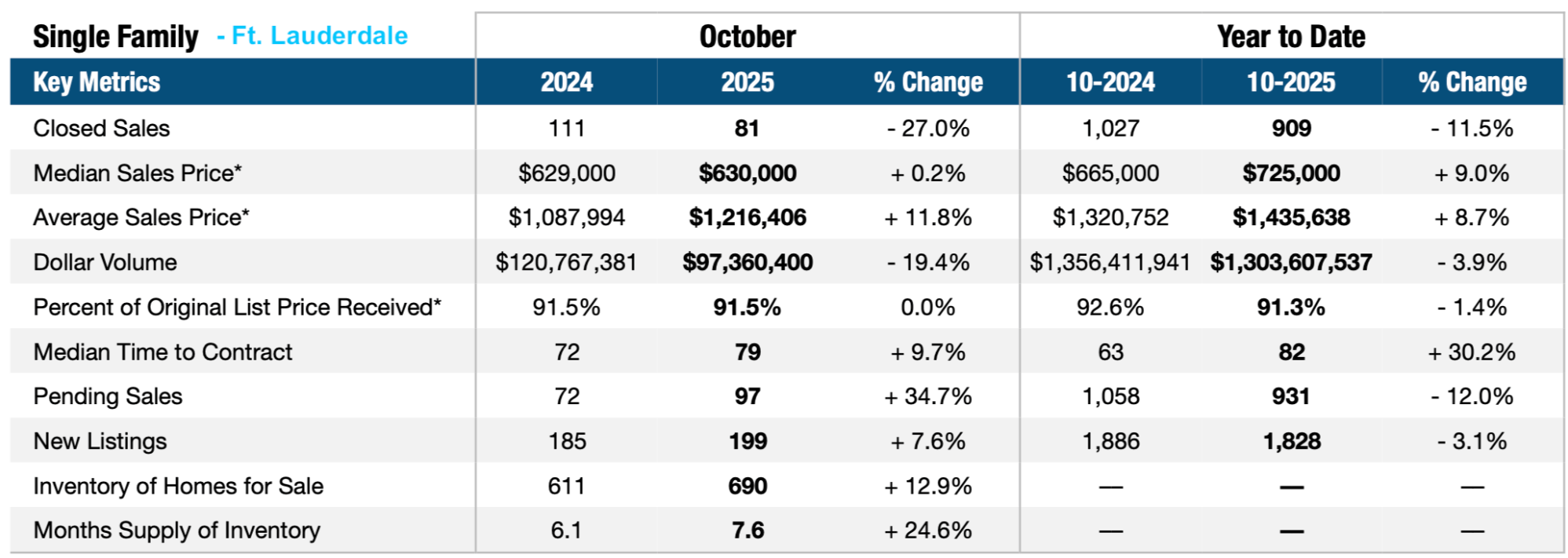

Fort Lauderdale – October 2025 Market Breakdown

Source: BeachesMLS, Local Market Update – October 2025, Fort Lauderdale

Single-Family Homes: A Market That’s Normalizing, Not Crashing

- Median Sales Price (October YOY): $629,000 → $630,000 (+0.2%)

- Median Sales Price (YTD): $665,000 → $725,000 (+9.0%)

- Average Sales Price (YTD): $1,320,752 → $1,435,638 (+8.7%)

- Closed Sales (October): 111 → 81 (-27.0%)

- Median Time to Contract (October): 72 → 79 days (+9.7%)

- Months Supply of Inventory: 6.1 → 7.6 months (+24.6%)

When you look at just the October-to-October median price, it looks like prices are flat and maybe even losing steam. But the YTD tells us something more nuanced: over the course of the year, single-family homes in Fort Lauderdale have seen moderate, healthy appreciation, not a boom and not a bust.

At the same time, sales volume is down and homes are taking longer to sell. With 7.6 months of inventory, this is much closer to a balanced market than the frenzy we saw in the last few years.

What this means for you:

- Sellers: You can still achieve strong prices, but you can’t outprice the market. Condition, presentation, and realistic pricing are key.

- Buyers: You finally have room to breathe. There’s more selection and less pressure to make rushed, over-asking decisions.

Condos & Townhomes: Strong October, Softer Year Overall

- Median Sales Price (October YOY): $360,000 → $425,000 (+18.1%)

- Median Sales Price (YTD): $446,000 → $415,000 (-7.0%)

- Average Sales Price (YTD): $666,041 → $636,911 (-4.4%)

- Median Time to Contract (October): 84 → 131 days (+56.0%)

- Months Supply of Inventory: 10.6 → 11.2 months (+5.7%)

This is a textbook example of why you can’t rely on YOY alone. If you only looked at October vs. October, you’d think Fort Lauderdale condos were on fire with an 18% median price gain.

But YTD tells the real story: condo prices are actually lower than last year overall, and inventory has climbed to more than 11 months of supply*. Buyers are taking longer to make decisions, and sellers have more competition. (* 11 "months of supply" means that if no more condos are listed for sale from today onwards, it would take over 11 months to sell our current inventory of condos at our current sales rate).

What this means for you:

- Buyers: This is quietly becoming a buyer-friendly segment. You may be able to negotiate stronger terms, especially on units that have been sitting.

- Sellers: You need to think like a buyer. Updated, well-presented units with realistic pricing will still move. Overpriced or dated units are going to linger.

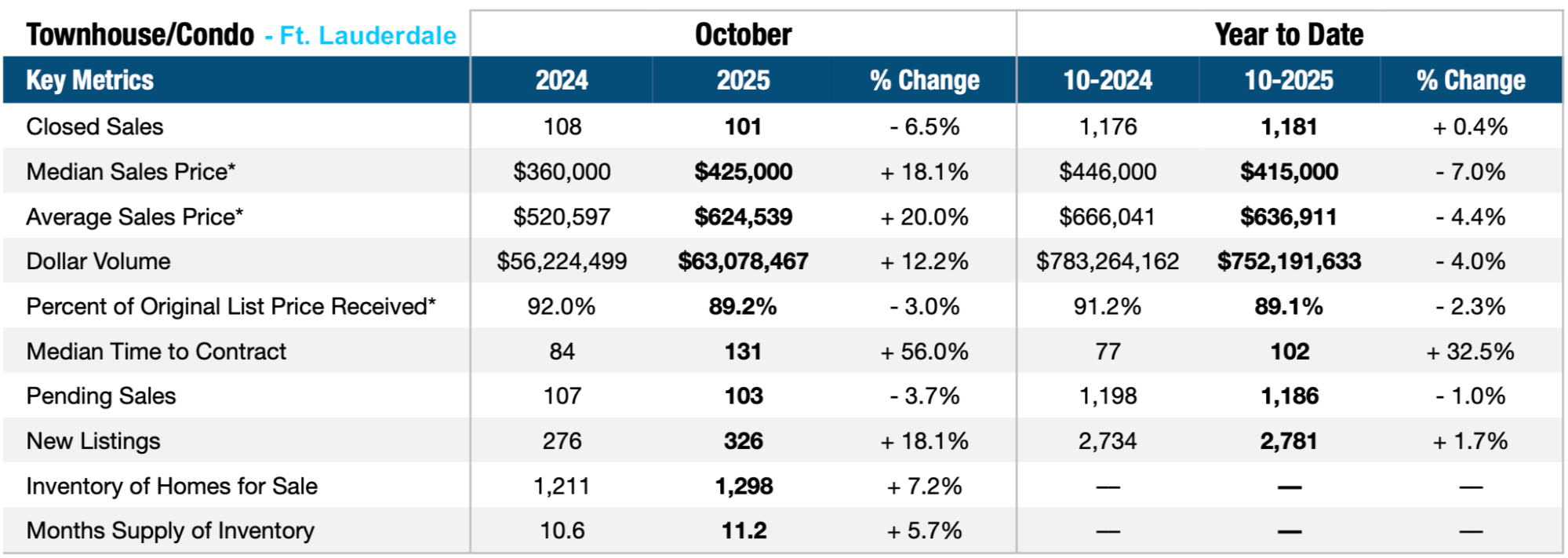

Wilton Manors – October 2025 Market Breakdown

Source: BeachesMLS, Local Market Update – October 2025, Wilton Manors

Single-Family Homes: Strong, but Not Out of Control

- Median Sales Price (October YOY): $705,000 → $852,500 (+20.9%)

- Median Sales Price (YTD): $760,000 → $799,000 (+5.1%)

- Average Sales Price (YTD): $873,244 → $948,488 (+8.6%)

- Closed Sales (YTD): 119 → 135 (+13.4%)

- Months Supply of Inventory: 6.7 → 5.6 months (-16.4%)

On the surface, that 20.9% October YOY jump looks like a rocket ship. But when you zoom out and look at YTD, what you see is steady, manageable appreciation in a very constrained market with limited single-family inventory.

Wilton Manors remains one of the most structurally strong single-family markets in Broward: demand is strong, land is limited, and the lifestyle continues to attract both local move-ups and out-of-state relocations.

What this means for you:

- Sellers: You’re in one of the better positions in the tri-city area. With the right pricing and preparation, you can still command premium values.

- Buyers: Waiting for prices to “crash” here is likely wishful thinking. Strategy and timing matter more than trying to time the bottom.

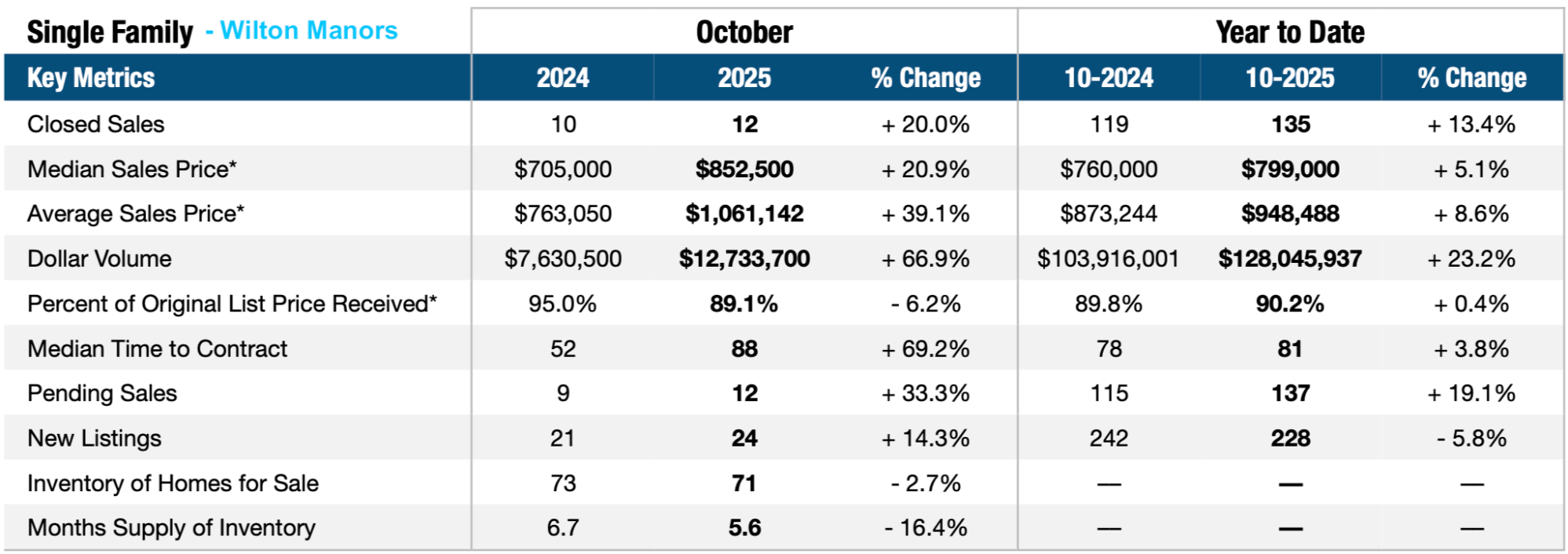

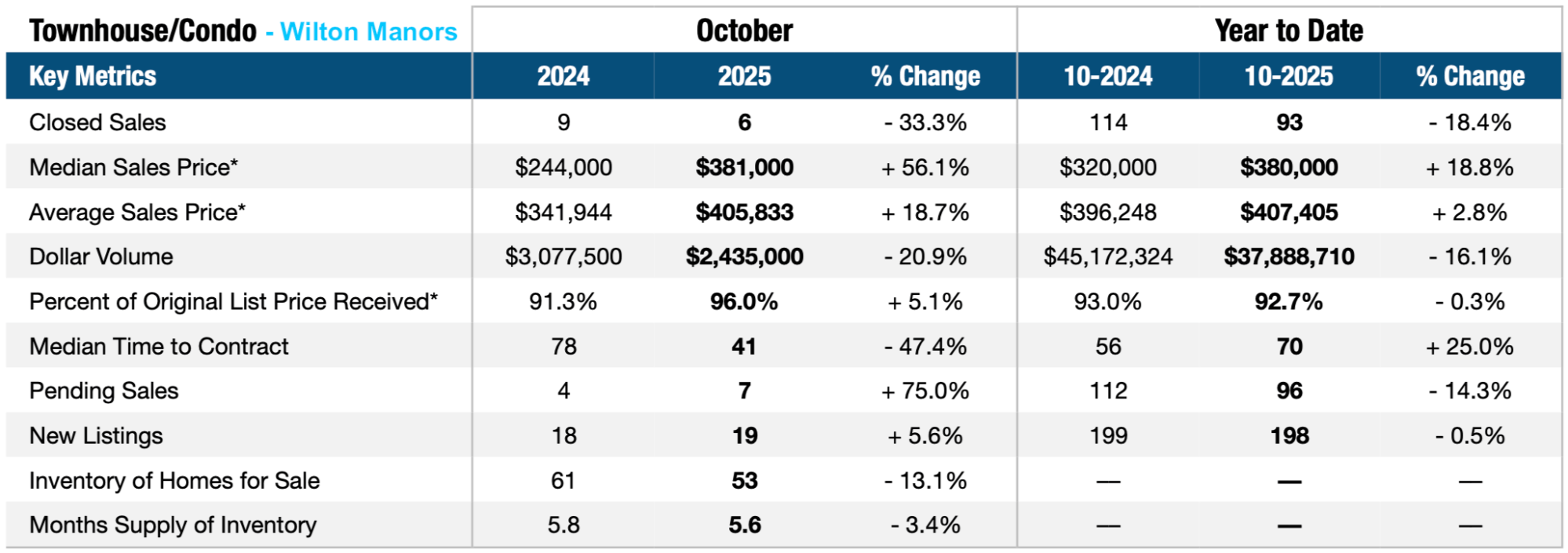

Condos & Townhomes:

- Median Sales Price (October YOY): $244,000 → $381,000 (+56.1%)

- Median Sales Price (YTD): $320,000 → $380,000 (+18.8%)

- Average Sales Price (YTD): $396,248 → $407,405 (+2.8%)

- Closed Sales (YTD): 114 → 93 (-18.4%)

- Months Supply of Inventory: 5.8 → 5.6 months (-3.4%)

Wilton Manors doesn’t have a large condo market, so the numbers can fluctuate with relatively few sales. That’s why October’s 56% YOY median gain needs to be taken with context: there were only 6 condo sales that month.

YTD is the better trend line here: median prices are up solidly, average prices are up slightly, and inventory is relatively tight. This segment remains stable to strong, even as transaction volume has stepped down.\

What this means for you:

- Sellers: Well-positioned condos and townhomes are still in demand, especially updated units in desirable communities.

- Buyers: There’s not a lot of “distress” here, but it’s still more approachable than the single-family segment in Wilton Manors.

Pompano Beach – October 2025 Market Breakdown

Source: BeachesMLS, Local Market Update – October 2025, Pompano Beach

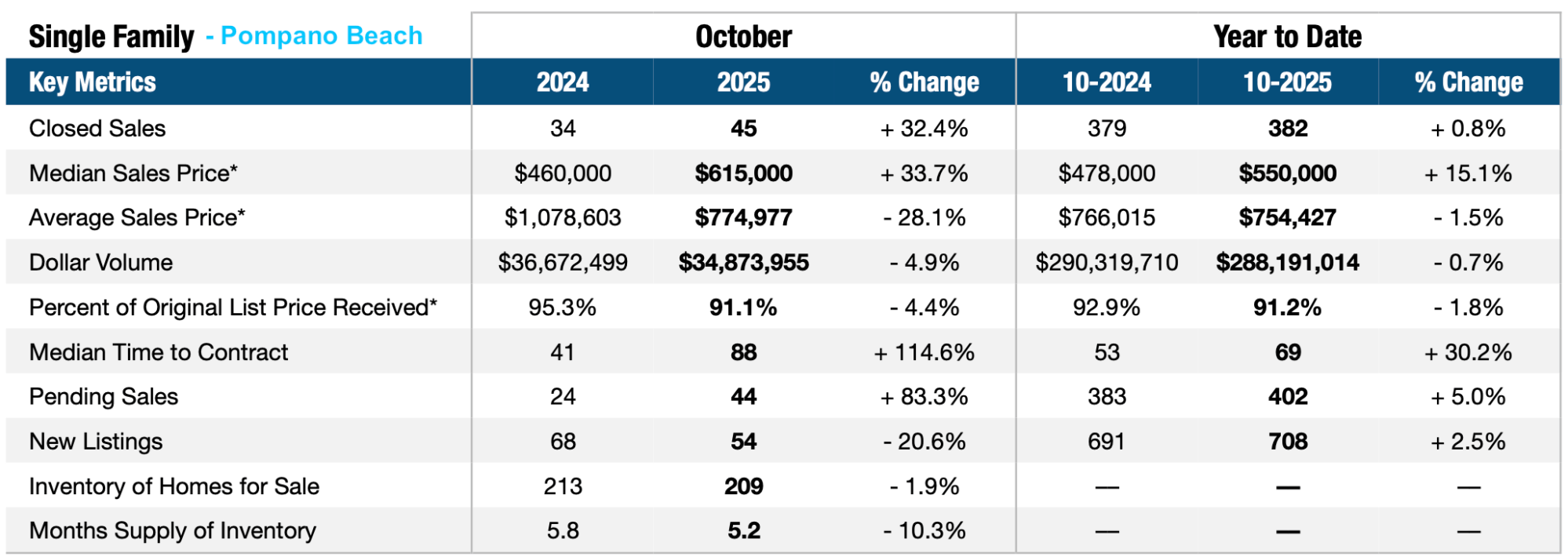

Single-Family Homes: Median Up, Average Flat

- Median Sales Price (October YOY): $460,000 → $615,000 (+33.7%)

- Median Sales Price (YTD): $478,000 → $550,000 (+15.1%)

- Average Sales Price (YTD): $766,015 → $754,427 (-1.5%)

- Closed Sales (October): 34 → 45 (+32.4%)

- Median Time to Contract (October): 41 → 88 days (+114.6%)

- Months Supply of Inventory: 5.8 → 5.2 months (-10.3%)

This is where median and average really pull apart. The median is up strongly—especially on a YOY basis—but the average is basically flat YTD. That tells us the sweet spot for buyers is the mid-range single-family home, not the ultra-luxury segment.

Days on market are up significantly, even though supply in months has edged down. In plain language: demand is real, but buyers are more cautious and deliberate.

What this means for you:

- Sellers: There’s still very good demand, especially for well-priced, well-presented homes. Overpricing, though, will be punished with longer market times.

- Buyers: Pompano remains a compelling value play compared to some neighboring cities, especially if you’re looking for a primary home or long-term hold.

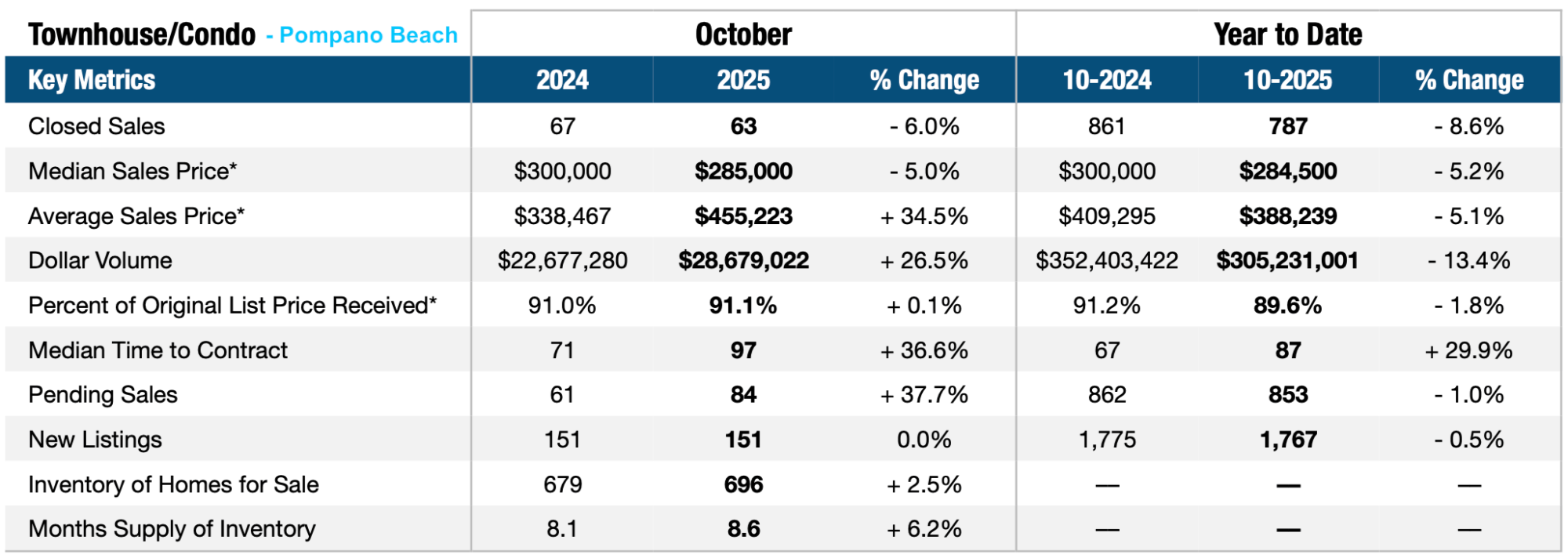

Condos & Townhomes: A Clear Softening Trend

- Median Sales Price (October YOY): $300,000 → $285,000 (-5.0%)

- Median Sales Price (YTD): $300,000 → $284,500 (-5.2%)

- Average Sales Price (YTD): $409,295 → $388,239 (-5.1%)

- Closed Sales (YTD): 861 → 787 (-8.6%)

- Median Time to Contract (October): 71 → 97 days (+36.6%)

- Months Supply of Inventory: 8.1 → 8.6 months (+6.2%)

Unlike some other segments, Pompano’s condo and townhome market is softening in a very consistent manner. Both YOY and YTD show price declines, rising days-on-market, and a buildup in inventory.

What this means for you:

- Buyers: This is one of the best opportunity segments in the tri-city area right now, especially if you’re open to doing some updates.

- Sellers: You’ll need to be highly competitive on price and presentation to stand out. Think staging, repairs, and great marketing—not just “list it and see what happens.”

So… Is the Market Hot, Cold, or Balanced?

The short answer: none of the above. It’s segmented.

- Single-family homes across these cities show moderate, sensible appreciation, with more balanced conditions and longer days on market.

- Condos & townhomes are where the softness shows most clearly—especially in Fort Lauderdale and Pompano Beach.

- Wilton Manors is the outlier with a structurally tight single-family market and a small but relatively healthy condo segment.

This is why it’s so important to look at the market both macro (citywide trends, YOY and YTD) and micro (your specific neighborhood, building, and property type). When you ignore that and only look at one dramatic number, that’s when misunderstandings—and clickbait—happen.

My Take: How to Use This Information for Your Next Move

After nearly two decades helping buyers and sellers in South Florida, here’s how I’d summarize where we are as of October 2025:

- This is no longer a runaway seller’s market. Inventory and days on market tell us that clearly.

- This is not a distressed buyer’s market either. Prices haven’t collapsed, and strong properties still sell.

- This is a data-driven, strategy-driven market. The right pricing, preparation, and timing matter more than ever.

For some, that means finally having enough breathing room to buy the right home instead of the only home. For others, it means getting serious about preparation before listing—rather than assuming anything will sell at any price.

If you want to cut through the noise and understand what these numbers actually mean for your property, I’m here for that conversation. We’ll look at the macro trends, the micro trends, the median and the average—and then build a strategy that fits your goals.

Source via BeachesMLS: Local Market Update – October 2025 for Fort Lauderdale, Wilton Manors, and Pompano Beach (Data courtesy of BeachesMLS, a subsidiary of Broward, Palm Beaches & St. Lucie Realtors®).

What Sellers Need to Know Heading Into 2026

The biggest shift heading into 2026 is that buyers are finally getting more selective — and the data backs that up. Days on market are up, inventory is higher in most segments, and the rapid-fire decision-making we saw during the 2021–2022 surge has been replaced with careful, calculated moves.

That doesn’t mean sellers are in trouble. It simply means the strategy that worked three years ago isn’t the strategy that works now. Here’s what matters most as we head into the new year:

- Pricing correctly from Day 1 is your biggest advantage. Overpricing leads to longer market times, more negotiations, and ultimately lower net proceeds.

- Presentation matters more than ever. In a balanced market, buyers have options. Homes that are clean, updated, staged, and professionally photographed rise to the top quickly.

- Understand your segment. Single-family homes are performing differently than condos and townhomes. The more competitive your segment, the more intentional your preparation needs to be.

- Median vs. average pricing can create confusion. If you’re selling a higher-end property, average pricing matters more. If you’re selling in a mid-range segment, median pricing is the truer guide. The right pricing model depends on your home.

- Condition and updates will separate you from the pack. Homes with new roofs, impact windows, modern kitchens, and polished curb appeal win the attention of today’s cautious buyers.

Heading into 2026, the sellers who succeed will be the ones who prepare thoughtfully, price strategically, and market with intention. It’s not a “throw it on the MLS and hope” market anymore — it’s a market where professionalism gives you the edge.

What Buyers Need to Know Heading Into 2026

The biggest advantage buyers have heading into 2026 is clarity. For the first time in years, you can actually see what’s happening in the market — longer days on market, more inventory, and pricing that’s stabilizing or even softening in certain condo and townhome segments.

But this isn’t a “wait forever” market, either. Here’s what to keep in mind:

- You finally have options. Inventory levels across Broward County — especially in the condo market — give you the ability to compare, negotiate, and be thoughtful.

- Interest rates may shift, but prices are unlikely to collapse. The YTD numbers show moderate single-family appreciation and stable demand. That points toward a balanced market, not a distressed one.

- Micro-trends matter more than macro headlines. Condo markets in Pompano Beach and Fort Lauderdale tell a different story than single-family homes in Wilton Manors. Focus on your price point, your product type, and your neighborhood.

- Median vs. average price helps reveal opportunity. Segments where the median is down but the average is up may indicate luxury units selling above trend while mid-range units soften — and that’s exactly where deals can be found.

- Updated homes still move fast. If a property checks the boxes — condition, updates, location, and price — don’t assume it will sit simply because the market has cooled.

Heading into 2026, buyers hold more leverage and more choice than at any point since before the pandemic. But the best opportunities will go to buyers who understand the data, stay pre-approved, and move decisively when the right home appears.

How to Plan Your Real Estate Strategy for 2026

As we head into 2026, the most successful buyers and sellers won’t be the ones trying to “time the market.” They’ll be the ones who understand it — the real one, not the headline version.

With the market shifting into a more balanced, segmented environment, your strategy needs to match your goals, your timeline, and your property type. Here’s what that looks like heading into the new year:

- Start with clarity, not assumptions. Whether you’re buying or selling, your strategy should be built around your personal timeline, financial comfort level, and the specific segment you’re operating in — not the latest viral headline or national story.

- Expect the pace to feel more “normal.” Gone are the days of 24-hour decisions and instant bidding wars. 2026 will reward thoughtful preparation, deeper due diligence, and better planning.

- Understand the segment you’re actually in. Single-family, luxury, mid-range condos, older buildings, waterfront homes — each of these is its own micro-market with its own behavior. The more accurate your market lens, the better your decisions.

- Lean into verified data. BeachesMLS data paints a very different picture than clickbait headlines. Use rolling trends, YTD performance, median and average pricing, and days on market to guide your expectations.

- Don’t underestimate the power of presentation and timing. For sellers, little things matter again — minor repairs, curb appeal, decluttering, staging, and professional marketing. For buyers, staying pre-approved and ready allows you to move quickly when the right home comes along.

- Plan for insurance, financing, and inspections early. In Florida, these components are as important as the property itself. Getting ahead of them can make or break your transaction.

At the end of the day, 2026 won’t be a market of extremes. It will be a market of strategy — where informed decisions and skilled guidance make all the difference. Whether you’re planning to buy, sell, invest, or relocate, my goal is to help you navigate the micro and macro trends with confidence and clarity.

If you're thinking about a move in 2026, let’s start the conversation early so I can help you position yourself to win — no drama, no guesswork, just A Better Real Estate Experience.

About Scott Morreau

Scott Morreau, PA is a top-rated Realtor and Broker Associate with Real Broker, LLC, specializing in residential real estate in Fort Lauderdale, Wilton Manors, Oakland Park, Pompano Beach, Dania Beach, and Broward County. Licensed since 2001 and active in South Florida since 2006, Scott has closed over $52 million in Florida real estate, including $7.1 million in the past year alone.

Ranked among the top 500 agents in the region with 70+ five-star reviews, Scott is a trusted resource for luxury and waterfront homes, investment deals (including 1031 exchanges), relocation, and LGBTQ+ clients. He is known for concierge-level preparation, expert market insight, and a client-first approach he calls A Better Real Estate Experience.

📲 Call or text Scott at (954) 562-5111 or visit Scott Morreau PA - Top Realtor Wilton Manors & Fort Lauderdale Real Estate

This article was drafted with the assistance of AI technology and may contain errors or omissions. For the most accurate and personalized guidance, please contact me directly.

Categories

- All Blogs (110)

- 01. Local News & Lifestyle (4)

- 02. Market Updates (18)

- 03. Home Prices & Inventory (8)

- 04. Mortgage & Interest Rates (11)

- 05. Affordability & Rent vs. Buy (8)

- 06. Buyer Tips, Myths & Guides (16)

- 07. Selling Tips, Myths & Guides (20)

- 08. Demographic Trends (11)

- 09. New Construction (6)

- 10. Real Estate News & Insights (4)

- 11. Featured Listings (1)

- 12. Community Spotlights (1)

- 13. Legal & Policy Updates (2)

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "