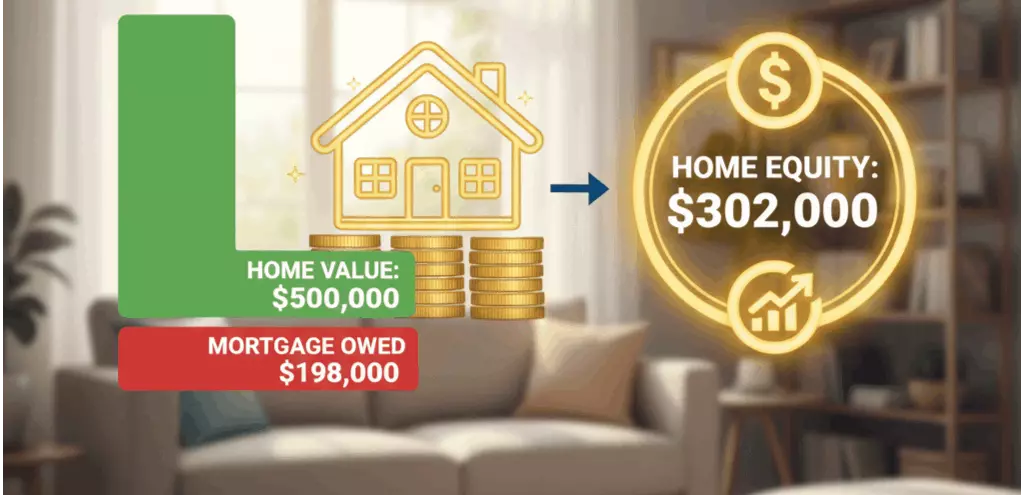

$302,000 in Home Equity Explained

Home Equity in Fort Lauderdale: What $302,000 Means for You

Here’s a stat that should grab your attention: the average homeowner with a mortgage in the U.S. now has about $302,000 in home equity. That’s a powerful number — and it speaks volumes about the strength and stability of today’s housing market.

If you own in Fort Lauderdale, Wilton Manors, Oakland Park, Pompano Beach, Dania Beach, or anywhere in Broward County, chances are your equity picture looks even stronger thanks to the high demand and lifestyle appeal of South Florida living. Let’s unpack what this means for you — whether you’re a homeowner, a seller, or someone looking to buy in today’s market.

Why $302,000 in Equity Matters

Equity is the difference between what your home is worth and what you owe on your mortgage. It builds steadily over time as you pay down your loan and as property values rise. For most homeowners, it’s one of the largest sources of wealth they’ll ever create.

At an average of three hundred and two thousand dollars, this equity cushion provides flexibility, opportunity, and peace of mind. It’s proof that your home isn’t just a place to live — it’s a financial tool working quietly in the background every single month.

What Equity Means for Homeowners

If you’re a homeowner in Broward County, you may be sitting on a significant amount of equity — even if you purchased just a few years ago. That equity can be used in several ways:

- Move up into your dream home without starting from scratch financially.

- Invest in a second property as a rental, vacation home, or long-term wealth builder.

- Renovate and upgrade your current home to enhance its comfort and value.

- Provide a financial safety net in times of uncertainty or opportunity.

Equity is leverage — and in South Florida’s dynamic market, it can open doors you didn’t think were possible.

Why This Is Good News for Buyers Too

Strong homeowner equity also stabilizes the market for buyers. Unlike during past downturns, when homeowners were overleveraged, today’s equity levels mean fewer distressed sales and more resilient property values. That stability makes your purchase in Fort Lauderdale, Wilton Manors, or Pompano Beach a safer long-term investment.

And with price appreciation cooling to a healthier pace, buyers now have the breathing room to shop, negotiate, and make smart moves without the chaos of the past few years.

Sellers: Equity Is Your Secret Weapon

If you’ve been considering selling, your equity is your biggest advantage. It positions you to move forward confidently, whether you’re downsizing, relocating, or trading up. Even in a balanced market, homes that are priced correctly and marketed beautifully are still selling — often with excellent returns for the seller.

The key is strategic pricing and professional presentation. In today’s market, your equity gives you the flexibility to price competitively, attract serious buyers, and still walk away with a strong gain.

Fort Lauderdale & Broward County: A Market Built on Strength

Local demand continues to shine in Fort Lauderdale and surrounding areas. From Wilton Manors’ vibrant community scene to Oakland Park’s growing dining district, to the waterfront lifestyle of Pompano Beach and Dania Beach — people want to live here. That steady demand supports property values and makes the equity picture even brighter for local homeowners.

Final Takeaway

Three hundred and two thousand dollars in average equity is more than a headline — it’s proof of the resilience and opportunity in today’s housing market. For South Florida homeowners, it’s a reminder that your property is not just a home, but also a powerful financial asset. And for buyers, it’s reassurance that this market is built on strong fundamentals.

TL;DR Summary

- Average U.S. homeowner equity is $302,000 — a huge wealth-builder.

- Equity provides options: moving up, investing, renovating, or stability.

- Strong equity creates a stable market for buyers in Fort Lauderdale and beyond.

- Sellers can leverage equity to move forward confidently and profitably.

- Broward County’s demand continues to support strong property values.

About Scott Morreau

Scott Morreau, PA is a top-rated Realtor® and Broker Associate with Real Broker, LLC, specializing in residential real estate in Fort Lauderdale, Wilton Manors, Oakland Park, Pompano Beach, Dania Beach, and the surrounding Broward County communities. Licensed since 2001 and active in South Florida since 2006, Scott has closed over $52 million in Florida real estate, including $7.1 million in the past year alone.

Ranked among the top 500 agents in the region, with 70+ five-star reviews, Scott is a trusted resource for luxury and waterfront homes, investment deals including 1031 exchanges, relocation in or out of South Florida, and LGBTQ+ clients. Scott is known for concierge-level preparation, expert market insight, and a client-first approach he calls A Better Real Estate Experience.

📲 Call or text Scott at (954) 562-5111 or visit Scott Morreau PA - Top Realtor Wilton Manors & Fort Lauderdale Real Estate

Categories

- All Blogs (132)

- 01. Local News & Lifestyle (5)

- 02. Market Updates (19)

- 03. Home Prices & Inventory (8)

- 04. Mortgage & Interest Rates (11)

- 05. Affordability & Rent vs. Buy (8)

- 06. Buyer Tips, Myths & Guides (20)

- 07. Selling Tips, Myths & Guides (26)

- 08. Demographic Trends (11)

- 09. New Construction (7)

- 10. Real Estate News & Insights (10)

- 11. Featured Listings (1)

- 12. Community Spotlights (1)

- 13. Legal & Policy Updates (5)

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "